Understanding Refinancing and Its Role in Preventing Foreclosure

Refinancing your mortgage can be a powerful tool to avoid foreclosure and regain financial stability. This guide will explain how refinancing works, its benefits, and the steps you can take to determine if it’s the right solution for your situation.

Refinancing involves replacing your current mortgage with a new one that has more favorable terms. This could mean a lower interest rate, extended repayment period, or a switch to a fixed-rate mortgage. By reducing monthly payments or making them more predictable, refinancing can help homeowners in Titusville, FL, who are facing financial difficulties stay in their homes.

Why Consider Refinancing?

Key Benefits of Refinancing:

- Lower Monthly Payments: Refinancing often results in reduced payments, easing financial strain.

- Avoid Foreclosure: By restructuring your mortgage, you can remain in your home.

- Predictable Payments: Switching to a fixed-rate mortgage eliminates surprises from fluctuating interest rates.

- Consolidate Debt: Some refinancing options allow you to roll high-interest debts into your mortgage.

- Access to Equity: Cash-out refinancing lets you tap into your home’s equity to cover financial emergencies.

Types of Refinancing Options

1. Rate-and-Term Refinancing

This option changes the interest rate or loan term of your mortgage. It’s ideal for lowering monthly payments or securing a fixed rate.

2. Cash-Out Refinancing

Allows you to borrow against your home’s equity to access cash for pressing needs, such as medical expenses or debt consolidation.

3. Streamline Refinancing

Offered for government-backed loans (FHA, VA), streamline refinancing simplifies the process with fewer documentation requirements.

4. No-Closing-Cost Refinancing

For homeowners short on cash, this option rolls closing costs into the loan balance, though it may result in a slightly higher interest rate.

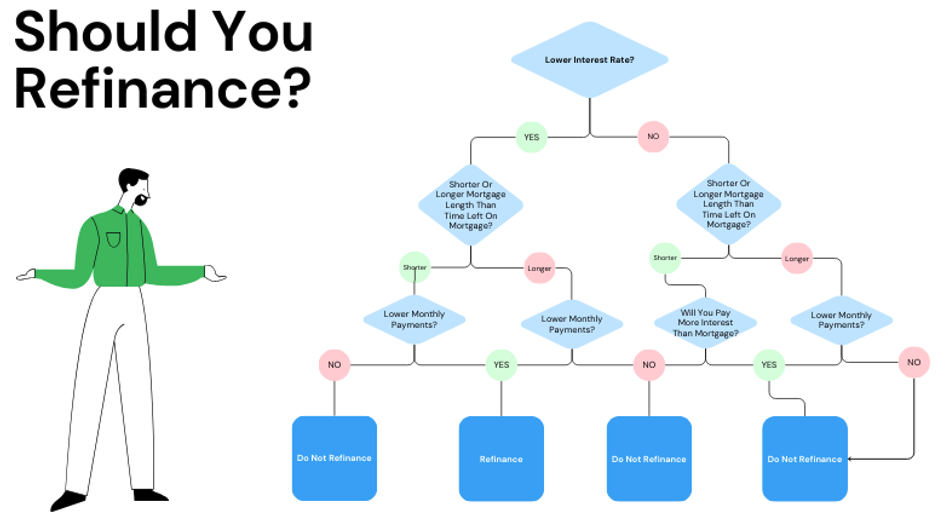

How to Determine if Refinancing Is Right for You

Key Questions to Ask:

- Can I secure a lower interest rate than my current mortgage?

- Will extending my loan term significantly lower my payments?

- Do I have enough equity in my home to qualify for refinancing?

- Can I afford the closing costs associated with refinancing?

Who Refinancing Works Best For:

- Homeowners with good credit scores.

- Those with sufficient equity in their property.

- Borrowers seeking long-term stability and lower payments.

The Refinancing Process: A Comprehensive Step-by-Step Guide

Refinancing can feel overwhelming, but understanding each phase of the process ensures you are prepared and confident in your decisions. Here’s an expanded and detailed breakdown of the steps involved:

Step 1: Assess Your Financial Health

Take a close look at your current financial situation. Start by gathering essential documentation, including:

- Tax Returns: Provide a snapshot of your income over the last two years.

- Pay Stubs or Proof of Income: Lenders will use these to confirm your ability to repay the refinanced loan.

- Debt and Expense Records: Outline your monthly expenses, including credit card bills, loans, and utility costs.

- Current Mortgage Statement: This shows the outstanding balance and terms of your existing loan.

Step 2: Define Your Refinancing Goals

Determine what you want to achieve with refinancing:

- Are you seeking lower monthly payments?

- Do you want to switch from a variable rate to a fixed rate?

- Are you looking to shorten or extend your loan term?

- Do you plan to consolidate other debts into your mortgage? Clearly defining your objectives helps you choose the right refinancing option.

Step 3: Shop Around for Lenders

Don’t settle for the first offer. Compare multiple lenders to find the best deal. Key factors to evaluate include:

- Interest Rates: Look for competitive rates that align with your goals.

- Loan Terms: Examine options for shorter or longer repayment periods.

- Fees: Identify closing costs, application fees, and prepayment penalties.

- Reputation and Support: Choose a lender with a strong track record and customer service. Online tools, local banks, and credit unions can provide diverse options for comparison.

Step 4: Submit Your Application

Once you’ve chosen a lender, complete the application process. Be ready to provide:

- Your detailed financial documents.

- Authorization for a credit check.

- Any additional information requested by the lender, such as proof of homeowners insurance or explanations for credit inquiries.

Step 5: Review the Loan Estimate

Within three business days of submitting your application, you should receive a loan estimate. This document outlines:

- Proposed Interest Rate: Understand how it compares to your current rate.

- Estimated Monthly Payment: Ensure it aligns with your budget.

- Closing Costs: Familiarize yourself with fees like origination charges, appraisal fees, and title services. Take the time to ask questions and clarify any terms you don’t understand.

Step 6: Underwriting and Appraisal

The lender will evaluate your creditworthiness and the value of your property. During this phase:

- An appraiser will assess your home’s value to confirm it supports the loan amount.

- The lender may verify your employment and recheck your credit report. Be prepared for any follow-up requests and respond promptly to avoid delays.

Step 7: Closing the Loan

Once approved, schedule your closing. At the closing meeting:

- Review the final loan documents carefully.

- Pay closing costs and other fees unless rolled into your loan balance.

- Sign the necessary paperwork to finalize the loan. After closing, your new mortgage terms will go into effect.

Refinancing is a detailed process, but with careful planning and the right support, it can be a key step in protecting your financial future.

Common Challenges in Refinancing

- Low Equity: Some homeowners may not qualify if their equity is insufficient. You should explore options like FHA streamline refinancing or consult with a mortgage specialist to identify alternative solutions.

- Credit Score Requirements: A low credit score can result in higher interest rates or loan denial.

- Closing Costs: These can range from 2-6% of the loan amount, impacting affordability.

- Timing Issues: Refinancing takes time; delays could exacerbate financial difficulties.

Alternatives to Refinancing

If refinancing isn’t an option, consider:

- Loan Modification: Adjust your loan terms for long-term affordability, such as reducing the interest rate or extending the loan term.

- Forbearance: Temporarily reduce or pause payments to recover from financial hardship, buying you time to stabilize your finances.

- Deed in Lieu of Foreclosure: Transfer ownership of your home to the lender to settle your mortgage debt.

- Short Sale: Sell your home for less than the mortgage balance with lender approval, avoiding foreclosure.

- Repayment Plan: Work with your lender to create a structured plan to catch up on missed payments over time, allowing you to stay in your home while addressing delinquencies.

- Reinstatement: Pay the total overdue amount in a lump sum to bring your mortgage current and avoid foreclosure proceedings.

- Government Assistance Programs: Explore federal or state programs, such as Florida’s Hardest-Hit Fund, which provide temporary financial aid to homeowners facing financial hardship.

- Renting Out the Property: Generate income to cover your mortgage payments by renting out your home. This can provide temporary financial relief while retaining ownership..

Frequently Asked Questions About Refinancing

How does refinancing affect my credit?

Refinancing temporarily lowers your credit score due to the hard inquiry but can improve it long-term with consistent payments.

What is the break-even point for refinancing?

The break-even point is the time it takes for savings from lower payments to offset closing costs. Calculate this to ensure refinancing makes financial sense.

Can I refinance with bad credit?

Options like FHA streamline refinancing or adding a co-signer can help homeowners with poor credit.

How I Can Help

As your dedicated real estate agent in Titusville, FL, I’m here to assist with the real estate-related aspects of refinancing, including:

- Providing Real Estate Expertise: I can help you understand how refinancing might impact your property value or future plans.

- Guiding You Through Documentation: I will ensure that all real estate-related documents are organized and ready for submission.

For other aspects such as legal or financial questions, I encourage you to contact appropriate professionals, like financial advisors or attorneys, to address those specific needs.

Contact me today to discuss your refinancing options and create a plan to protect your home. If refinancing doesn’t seem like the right solution for you, we can explore the option of selling your home as an effective way to resolve your financial situation.

Richard Overvold

Phone: (321) 507-8428

Email: contact@teamovervold.com

Florida Real Estate License Number: SL3610484

Important Disclaimers

Real Estate Services Disclosure: I am a licensed real estate agent in Florida. This guide is for informational purposes only and does not constitute legal or financial advice.

Fair Housing Compliance: I provide services without discrimination based on race, color, national origin, religion, sex, familial status, or disability.

Privacy Commitment: All information shared will remain confidential and used solely to assist with your real estate needs.